- Our Products

-

An agile launch execution platform, with full visibility across countries and

functions.

An agile launch execution platform, with full visibility across countries and

functions.

-

A collaborative platform for teams who plan reimbursements and HTA activities.

A collaborative platform for teams who plan reimbursements and HTA activities.

-

A collaborative platform designed to manage pharmaceutical tenders across

countries.

A collaborative platform designed to manage pharmaceutical tenders across

countries.

-

A capability management platform that unifies capabilities, resources, and assessment.

A capability management platform that unifies capabilities, resources, and assessment.

-

Manage your entire pipeline. Track every move. Stay ahead, from discovery to launch.

Manage your entire pipeline. Track every move. Stay ahead, from discovery to launch.

-

- Our Expertise

- Free Guides

- Blog

- Contact

Our products

Tender Management in Pharma

Tender management is a fact of life in a market where healthcare systems and payers always look for new ways to maximise finite budgets for pharmaceuticals. Are you going into tenders with your eyes wide open? Are you planning and tracking tenders as efficiently as you could? Are you executing with excellence, putting together the best possible bids, drawing on the full wealth of knowledge, awareness, expertise and experience from across your organisation?.

At TRiBECA ® Knowledge can help you make sure that pharmaceutical tenders give you the right competitive edge, rather than leaving you on the sidelines. SmartTender™, our pioneering collaboration software for tender management, will ensure that tender processes are fully informed, start on time, stay on schedule and consistently re-affirm best practices across your tender markets worldwide.

If you have a new product coming up for tender, it is not enough to expect that scientific ingenuity, a compelling value proposition or long years of R&D effort will guarantee you enthusiastic uptake at a premium price. Securing market access for pharmaceuticals is now tougher than ever, and tenders make it even harder.

Since medicine supply tenders are going to be unavoidable in some contexts, and you may have very little say in setting the terms, you need to be absolutely clear about the expectations and competitive dynamics involved.

You must understand precisely the timing, significance and requirements of each stage in the tender process, and how you can differentiate your product effectively in what is all too often a race for the lowest price.

Getting the tendering process right, and making sure your global and local resources are properly aligned towards that goal, will make all the difference between riding the trend towards competitive bidding for medicines to a broader, more flexible revenue base, or just watching competitors reap the benefits.

Emerging-market pressures

With emerging markets reining in pharmaceutical spending, companies can expect more stringent conditions for tenders as part of a whole spectrum of cost-control initiatives.

In the private retail segments of these markets, driven largely by out-of-pocket payments, more expensive medicines can be targeted at pockets of wealth in sharply polarised economies. In publicly funded healthcare systems, however, tender mechanisms are an inevitable trade-off for market access and volume-driven sales.

As key emerging markets such as China, Brazil and Russia make concerted efforts to expand healthcare coverage, there is likely to be even more emphasis on public procurement, and more recourse to cost-management strategies such as tenders.

Analysts from McKinsey & Company expect nearly 51% of the population in the Asia Pacific region to come under some form of universal health coverage over the next five to ten years.

Pharmaceutical companies carving out a presence in emerging markets recognise their inherent volatility and the need to take a long view. That includes understanding and managing the many variables in national, regional or institutional tender systems.

More tenders in developed markets

The use of tenders or joint-procurement mechanisms is also growing in established territories such as Western Europe, with their tradition of broad coverage through publicly financed healthcare systems.

Governments in these markets are increasingly concerned about the sustainability of drug budgets in the face of premium-priced speciality medicines in categories such as oncology, hepatitis C, rare diseases or, latterly, gene and cell therapies.

One measure of this unease was the European Commission’s introduction in 2014 of new provisions for bulk purchases of pandemic vaccines and other ‘medical countermeasures’ against infectious diseases.

Since then, a number of smaller EU member states, such as Bulgaria and Romania, or the Netherlands, Belgium, Luxembourg and Austria, have forged cross-border alliances to leverage information exchange and joint bargaining when negotiating the pricing and reimbursement of costly new medicine.

Ireland joined the so-called Beneluxa Initiative on Pharmaceutical Policy (originally just Belgium and Luxembourg) in June 2018, making it a five-country alliance. Switzerland has also shown an interest in joining.

In May 2017, the health ministers of six southern European member states – Malta, Cyprus, Greece, Italy, Spain, and Portugal – signed the ‘Valletta Declaration’ to promote transparency and cooperative action on accessibility and affordability of medicines, which could include joint price negotiations. Romania, Slovenia and Croatia (as observers) are now also part of this group.

Meanwhile, pharmaceutical tendering at national or sub-national level in Europe is becoming more diverse and extensive. Among recent trends in European tenders have been an increase in direct negotiations with suppliers; expanding the scope of tenders, particularly to include large-molecule biopharmaceuticals coming under challenge from biosimilars; and value-based tendering involving considerations other than price.

All of these trends are also amplified by the growing importance of vaccines to diversified pharmaceutical companies. This reflects partly the expansion of immunisation programmes in newly industrialised countries such as China.

Opportunities and challenges

As we have outlined in the TRiBECA ® Knowledge blogs ‘Resolving the new market access challenges created by tenders’ and ‘Unlocking new growth for your brand with better pharmaceutical tender management’, tenders remain a rich growth opportunity for pharmaceutical companies.

At the same time, they present considerable market access challenges, especially as product value and outcomes increasingly shape payer decision-making at all levels of the market (see our blog on Getting your launch strategy right for today’s market access paradigm).Tenders need to be based on a global value dossier adaptable to very specific local circumstances.

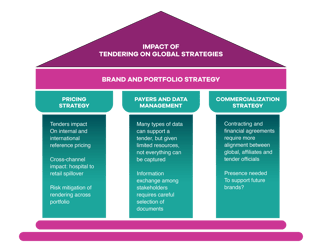

Tender processes and contract management can be complex, highly variable and sometimes obtuse, with potential ramifications globally for business strategies, commercial activities, pricing, stakeholder relations, channel management and brand equity (see Figure 1).

These difficulties may be aggravated in some markets by lack of clarity and transparency on, for example, timings and price points of tenders, as well as tacit or overt preference for local manufacturers.

Nor are companies always making the best use of the available opportunities. “In many markets, the individuals in charge of contracting and tendering processes simply use Microsoft Excel spreadsheets to track historical bid prices, and decision-makers lack ready access to data or the tools they need to drive actionable insights,” commented analysts from Accenture Life Sciences in a November 2016 report.

Where tender products have come off-patent, multinational bidders also need to deal with generic competitors in local markets “whose price points are generally unknown”, they pointed out.

Market-to-market variations

Conditions for tenders differ significantly from market to market, subject to local factors such as seasonality, level of need, available budget, industrial and health policy, competition and pricing trends.

Tenders may also come in varying formats, such as open or restricted tendering, competitive negotiation or direct procurement, as well as global or regional pooled-procurement initiatives.

Timing is always crucial, yet public programmes and related government tenders in emerging markets may be organised on an ad hoc basis that frustrates cycle planning and demand forecasting.

Vaccine tenders bring additional complications, such as the World Health Organization’s (WHO) prequalification system for vaccines acquired by procurement agencies in United Nations member countries. Quality and safety are even more critical with vaccines than with medicines, since vaccines are administered to healthy individuals in large numbers.

Production lead times for vaccines are longer than for medicines, pricing is increasingly complex and contracts may, according to the WHO, include “assured volumes, upfront payment, multi-year contracts, bundling of products, discounts and rebates, etc”.

Multiple barriers to access

Vaccine manufacturers face multiple barriers to access, such as awareness; affordability; scientific evidence; government policy and vaccine schedules; funding cycles and mechanisms; tender processes; and the overall competitive environment.

Failure to achieve timely uptake in target markets can put vaccines out of commission for extended periods, depending on procurement cycles and contract lengths.

Adding to all of these challenges, whether for pharmaceuticals or vaccines, is lack of cross-functional communication within companies making tender offers, or inconsistent processes for planning and tracking tenders effectively.

Tender managers who fail proactively to monitor and track the publication of tenders, or systematically to capture data on previous tender submissions, risk coming into the bidding process too late to put together a compelling, high-quality and fully documented offer.

Competitive insights should be collected systematically throughout the tender cycle, using a reliable system that stores and shares insights for the benefit of future submissions. Without a formal and cross-functional tender-management system, companies will only create inefficiencies through duplication of effort.

Companies must also understand the decision drivers for each tender, whether these vary across therapeutic areas, diseases and/or care setting, and what kind outcomes data, services or solutions will best address payer concerns around disease management.

Tracking tenders in real time

This puts all the more onus on companies to visualise and track tender status in real time, both at global and local level, and across the various organisational silos involved in planning and executing tenders.

The right people in your organisation must have access to the right tender data, contacts and documentation, as and when they need them. That includes any accumulated history and experience with tenders in particular markets, which will help you deliver compelling and timely submissions geared to national tender conditions and competitive parameters.

Your organisation’s ability to overcome tender management challenges will depend in particular on:

- Full visibility of tender status, forecasts and timelines across the business. You need a system

that will proactively and systematically monitor and track upcoming or expected tenders in each

country where they occur, when they occur, and across brands and functional silos. Often by the

time a product is actually out to tender, it is already too late to start putting together a viable bid.

• Timely decision-making. With an automated, clear and co-ordinated process for evaluating

tenders and making early bid/no bid decisions, you can ensure you make the right choices for your

business and deliver them on schedule.

• Automating and streamlining document fulfilment. You must make sure you have all the right

data and documentation to hand, with seamless transmission from global or regional to country

level. That way, work on your submission can start early enough for you to launch a timely and

high-quality tender.

• Collaboration across internal silos. For maximum efficiency in tendering, you need to ensure

global and country tender teams, as well as the different departments within each country team

responsible for a tender submission, are all working together and in line with strategic imperatives.

• Building tender insights. With the right integrated system, you can systematically build a

database of knowledge, data and competitive insights to inform forecasting and leverage into

future tenders.

• Measuring and monitoring KPIs. By tracking and evaluating key performance indicators in real

time, you can ensure your tender management tool is helping to drive performance across the

business.

A customised framework and intelligent digital tools for real-time tender tracking, planning and management, applied systematically across brands, countries and organisational boundaries, will enable you seamlessly and promptly to order any documents (safety certificates, licences, etc) you need for each tender and, where appropriate, tailor them to the local market.

Our SmartTender tender management software will facilitate collaborative working on medicine supply tenders regardless of territories and corporate structures. It will make sure tender processes start on time, stay on schedule and follow best practices.

If your tender submissions are incomplete or sub-standard, they run the risk of disqualification both now and in the future. You can mitigate that risk with our fully co-ordinated and integrated tender management tools, giving you 360˚ oversight of tender requirements and whether you can meet them on time.

Moreover, by maintaining full visibility of procurement processes worldwide, global tender managers will find it easier to monitor and measure associated key performance indicators (KPIs), or to enrich their tender forecasts, whether at the financial or the supply level.

Just ask yourself: are you really managing your tenders as effectively and seamlessly as you could do? Is everyone involved in tender management working together as fruitfully as they should be, and towards the same goals? Do you have full visibility of tender management across workstreams and countries worldwide?

If there is room for improvement, you should be talking to us. We can show you how, with the right support and technology, you can overcome the growing challenges of tender management worldwide and support healthcare system in their efforts to realise cost-efficiencies in drug purchasing.

At the same time, you will be able to optimise the potential of pharmaceutical assets subject to tender, to the significant benefit of your business and patients alike.