Companies seeking new sources of growth all the way from Europe to Africa can ill afford to ignore the benefits of well-managed pharmaceutical tenders.

Having the right tools in place to monitor and track prospective and ongoing tenders across a wide range of scenarios and markets recognises just how important this channel is to sales and margins in an increasingly cost-sensitive environment for medicines and vaccines.

A 360˚ view of tender processes, both internally and externally, is critical to maximising efficiency, identifying and acting on the most promising tender offers, enhancing the quality of tender submissions, and learning from experiences in the marketplace. That way, the full potential of tenders as a growth driver for pharmaceuticals can be released both now and in the future.

Anything but niche

Tenders are anything but a niche activity these days. According to some estimates, around 25% of pharma business now comes through medicine supply tenders or contracts. Pfizer, for example, runs a network of more than 80 countries planning, managing and tracking tenders.

That reflects market access challenges linked to escalating drug and healthcare costs, particularly in emerging markets that rely on procurement mechanisms to eke out limited funds by driving down prices.

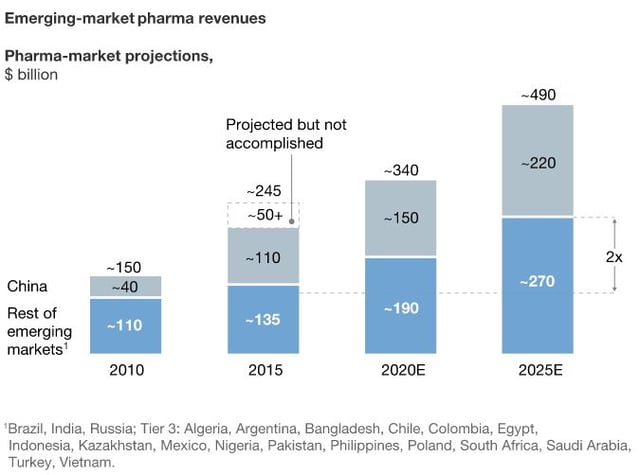

While the pace of pharmaceutical globalisation has faltered somewhat in the backwash of worldwide recession (see Figure 1), drug revenues in China and the other top 20 emerging markets are still expected to double over the next ten years.

Figure 1: Adjusting expectations for emerging-market growth

Source: BMI Research - McKinsey&Company

These countries’ large populations and efforts to expand healthcare coverage serve as an antidote to aggressive cost containment in the relatively saturated markets of North America, Western Europe or Japan.

And if the cost of entry is volume-driven business at lower prices, then McKinsey & Company believes the top 21 emerging markets will account for 31% of pharmaceutical industry sales worldwide by 2025.

Gaining traction in Europe

Tenders are also gaining traction in Western European markets with a tradition of inclusive, publicly funded healthcare coverage. This is nothing new: as Eva Marchese, now vice-president at Charles River Associates, has pointed out, it is“easy at the global level to forget that tenders are the second step of the access process at the sub-national level in most EU countries”.

In parallel, the impetus to use collaborative procurement in Europe as a defence against untenable cost inflation from medicines is growing with encouragement from bodies such as the World Health Organization and the European Commission.

Another driver for tenders is the growing significance of vaccines to diversified pharmaceutical businesses, encouraged in part by expansion of immunisation programmes in newly industrialised countries such as China.

Getting the tools right

Any company looking to future-proof its business in an increasingly multi-layered marketplace should give serious consideration to management strategies for international pharmaceutical and vaccine tenders.

They should also bear in mind that the tendering process can be complex. Conditions vary significantly from market to market, subject to local factors such as seasonality, level of need, available budget, industrial and health policy, competition and pricing trends.

In some markets there may be lack of clarity and transparency around timings and price points, as well as tacit or overt preference for local manufacturers. Moreover, tenders come in different formats, such as open or restricted tendering, competitive negotiation or direct procurement, and global or regional pooled-procurement initiatives.

Getting the tools right to stay on top of tender schedules, understand the global and local landscape, and deliver against specifications with maximum efficiency, responsivene-sss and synergy, will give your brands the edge they need really to make tenders count.

As our new Tender Management Checklist makes clear, that is to the advantage both of patients in need and the company’s own bottom line, in a market where cost sensitivity, global integration and local agility are non-negotiables for survival and prosperity.

TRiBECA® Knowledge is a market leader in smart business tools that help pharmaceutical companies successfully launch and commercialise products. Our tools enhance visibility and transparency, streamline processes and drive communication and collaboration across brands, management layers, business functions and countries worldwide.

Andre Moa

Andre Moa

14 Dec 2017

14 Dec 2017

5 minute read

5 minute read