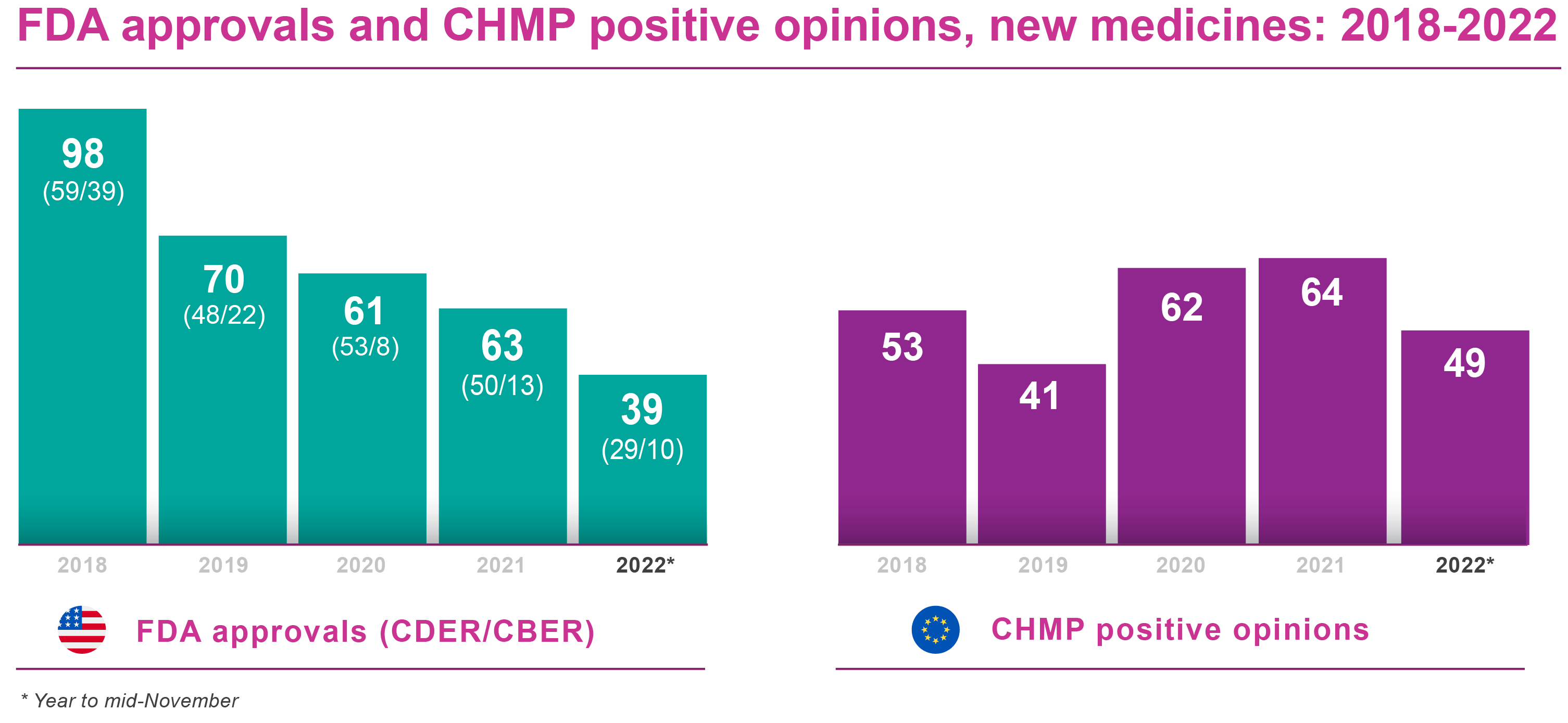

With only weeks left to run in 2022, new drug approvals across the two most important markets for the pharmaceutical industry were in only middling shape. The European Medicines Agency, at least, looked as though it might get close to its approval tally for 2021. In the US, however, 2022 new drug approvals seemed to be heading for a distinct slump.

If drug approvals in the European Union and the US are one barometer of industry’s commercial health and R&D productivity, then these trends should give us pause. As the disruptive impact of the COVID-19 pandemic finally started to recede in 2022, it might have been reasonable to expect a return to some kind of regular approval pattern. Whether the lag in the US points to any longer-term trend, though, is hard to determine.

Approvals held up remarkably well under pandemic conditions in 2021, without even factoring in Emergency Use Authorizations (EUAs) for COVID-related vaccines and other treatments by the US Food and Drug Administration. As of mid-November 2022, though, the FDA’s Center for Drug Evaluation and Research (CDER) had cleared only 29 new medicines and therapeutic biologics for marketing, well behind the CDER’s tally of 42 at the same point in 2021. CDER granted a total of 50 marketing authorisations during the whole of 2021.

By mid-November 2022, approvals of vaccines and other biological products through the FDA’s Center for Biologics Evaluation and Research (CBER) were only slightly lagging behind the previous year, with 10 product or other licences signed off in the year to date, compared with 11 at the same stage of 2021. CBER granted 13 licences overall in full-year 2021.

Neither of these US approval counts included Emergency Use Authorizations (EUAs), which the FDA has used quite extensively to boost its therapeutic and preventive arsenal against COVID-19. Among the licence applications cleared by CBER, on the other hand, was full approval for Spikevax, Moderna’s vaccine for coronavirus.

The FDA had a slow start to 2022. CDER approved just 16 new medicines in the first half of this year, while CBER awarded seven biologics licences. Barring an avalanche of new drug registrations during the final month-and-a-half of 2022, the FDA is heading for its lowest annual approval tally for many years (see Table 1 below). In 2018, for example, CDER and CBER between them waved through 98 new drug or biological licences.

Even if 2020 and 2021 were relatively quiet years, with 61 and 63 new drug approvals respectively (CDER + CBER), it looks unlikely the FDA will scale even those heights in 2022. Reviewing the situation in early September, though, Evaluate Vantage said it had identified 22 FDA approval decisions still to come this year (especially in November/December), based on listed drug developers tracked by sell-side financial analysts.

Lag in FDA approvals 2022

The reasons for the fall-off are not that clear, particularly as the FDA more than maintained its approval rate in 2021 versus 2020. It may be facile to lay everything at the door of COVID-19. However, the pandemic could have some lingering impact on regulatory activity in terms of, for example, approval backlogs or staff shortages.

The FDA may also be treating novel drug applications with particular caution, after sustaining heavy criticism for granting an accelerated approval to Biogen’s novel Alzheimer’s disease therapy, Aduhelm (aducanumab) in June 2022. It could even be that the pharmaceutical industry is just putting in fewer submissions.

There are already warnings that industry may in future take fewer risks entering the US market, due to the projected impact of the Biden administration’s Inflation Reduction Act, as well as proposals to rein in the FDA’s accelerated-approval pathway. Given shareholder expectations, though, and pressure to keep the innovation wheels turning, it seems unlikely companies would slack off at this stage, and to this extent. The reality may equally be a temporary blockage at the FDA due to unforeseen and/or hard-to-define circumstances.

EMA approvals 2022

While the pharmaceutical industry is substantially globalised, the US and the European Union remain the two pivotal launching pads for innovative medicines worldwide. So, has the European Medicines Agency kept up its end?

More or less, unless there we see a marked slowdown in approvals towards the end of the year. As of mid-November, the agency’s Committee for Medicinal Products for Human Use (CHMP) had issued approval recommendations for 49 new medicines, therapeutic biologics and vaccines . That compared with 47 positive opinions in year-to-date 2021 and an exceptional 64 approval CHMP recommendations for the full year.

In most cases, the European Commission follows the CHMP’s positive opinions and grants approval to market a new medicine throughout the EU. There may be several months’ delay between recommendation and Commission sign-off. At the time of writing, 34 of the 49 new products recommended by the CHMP had secured marketing authorisations (full or conditional) from the Commission, according to publicly available information.

Continuing impact of COVID-19

Year-to-year tallies can be misleading, especially if there is spillover in drug approvals from the end of one year to the beginning of the next. In recent years, perceptions have been further muddied by conditional approvals for vaccines and therapies addressing the urgent needs of COVID-19.

The approval figures for 2021 and 2022 did include some product specifically for COVID treatment or prevention. Their impact, though, has been largely marginal, at least in the US. Initial approvals of COVID-19 vaccines started filtering through in December 2020, although these were conditional. Conditional approvals do, nonetheless, show up as recommendations in the CHMP’s monthly meetings.

The FDA’s annual approval lists do not include its EUAs, which skews any direct comparison of US and EU approvals. A more meaningful guide is US and EU approvals independently from one year to the next (see Table 1 above).

Other than Spikevax, COVID-19 does not feature at all among the new products cleared by the FDA in 2022 to date. In the EU, on the other, the CHMP’s positive opinions for the year so far include:

- A recommendation on 27 January for conditional approval of Pfizer’s Paxlovid (PF-07321332 + ritonavir), to treat COVID-19 in adults not in need of supplemental oxygen but at increased risk of severe disease. The European Commission granted Paxlovid a conditional marketing authorisation the following day. It was the first oral antiviral approved in the EU for treating COVID-19.

- On 24 March, CHMP recommended a full marketing authorisationfor AstraZeneca’s Evusheld (tixagevimab and cilgavimab), to prevent COVID-19 in adults and adolescents over 12 years of age. Tixagevimab and cilgavimab are monoclonal antibodies designed to attach to the spike protein of the SARS-CoV-2 virus at two different sites.

- On 3 June, the CHMP delivered a positive opinion on Valneva’s COVID-19 Vaccine (inactivated, adjuvanted) Valneva. The European Commission signed off the approval the following day.

For the purposes of this review, FDA approvals omit generics and biosimilars. The CHMP recommendations here do not include generics or biosimilars either, nor products approved through hybrid or informed consent procedures that rely on pre-existing data from other medicines or biologics.For FDA registration, the CDER lists ‘novel medicines’, which are typically, but not exclusively, new molecular entities or NMEs and can extend to diagnostic agents. CBER approvals include gene/cell therapies and vaccines, but many of them are for screening tests, assays or reagents.EMA-approved ‘new medicines’ include chemically based drugs as well as biologicals and vaccines. Whether products awaiting final EMA registration are actually ‘new active substances’ – the nearest equivalent to FDA-approved NMEs – is not clear until the European Commission gives its approval and the relevant documentation appears on the EU’s website. |

Breakthrough innovation

Volumes apart, the approval lists for new medicines in 2022 tell us that, in addition to vaccines or therapies for COVID-19, breakthrough innovation continues to underpin US and EU approvals, especially for rare diseases. The lists include gene and cell therapies as well as other novel approaches to previously intractable or inadequately managed diseases. Some examples include:

- In January 2022, the CHMP recommended EU approval for Bristol-Myers Squibb’s Breyanzi (lisocabtagene maraleucel), a gene therapy for diffuse large B-cell lymphoma, primary mediastinal large B-cell lymphoma and follicular lymphoma grade 3B.

- In February 2022, the CHMP gave a positive opinion on Immunocore’s Kimmtrak (tebentafusp) for the treatment of uveal melanoma, a rare type of eye cancer. Tebentafusp, the active substancein Kimmtrak, is a bispecific fusion protein that stimulates immune cells.

- In March 2022, the CHMP recommended conditional approval for Janssen-Cilag’s Carvykti (ciltacabtagene autoleucel), an advanced CAR (chimeric antigen receptor)-T cell therapy for adult patients with relapsed and refractory multiple myeloma.

- In May 2022, the CHMP gave a positive verdict on PTC Therapeutics International’s Upstaza (eladocagene exuparvovec), a gene therapy for severe aromatic L-amino acid decarboxylase (AADC) deficiency, an ultra-rare, inherited genetic disease that typically manifests in the first year of life.

- Also in May 2022, the CHMP recommended EU approval for Genzyme’s Xenpozyme (olipudase alfa), an enzyme-replacement therapy and the first specific treatment for Acid Sphingomyelinase Deficiency, a rare and progressive genetic disease.

- The FDA approved Immunocore’s Kimmtrak in January 2022 (see under orphan drugs), Genzyme’s Xenpozyme in August 2022, and Janssen’s Carvykti in February 2022.

- Other than breakthrough approvals overlapping with the EU, and the orphan-drug approvals noted below, CDER notably cleared Eli Lilly’s Mounjaro (tirzepatide) to improve blood sugar-control in adults with type 2 diabetes, in May 2022. Mounjaro is a first-in-class medicine that activates both the GLP-1 (glucagon-like peptide-1) and GIP (glucose-dependent insulinotropic polypeptide) receptors.

- In August 2022,CDER approved Amylyx Pharmaceuticals Relyvrio (sodium phenylbutyrate/taurursodiol), an orphan drug for amyotrophic lateral sclerosis (or Lou Gehrig’s disease.

- Also in August 2022, CBER cleared for marketing bluebird bio’s Zynteglo (betibeglogene autotemcel), the first cell-based gene therapy for adults and children with beta-thalassaemia who require regular red blood-cell transfusions.

- In September 2022, CBER approved bluebird bio’s Skysona (elivaldogene autotemcel), the first cell-based gene therapy for slowing the progression of neurologic dysfunction in boys aged 4-17 years with early, active cerebral adrenoleukodystrophy.

The shift to specialty drugs

Many of the breakthrough medicines listed above are indicated for rare diseases, consolidating a trend in recent years for pharmaceutical R&D to focus on specialty drugs, and in particular orphan drugs addressing unmet needs. Of the 49 products recommended for approval by the CHMP in the year to date, 23 were orphan medicines (19 out of 47 in the same period of 2021).

The US FDA is on a similar track. In 2021, 26 or 52% of CDER’s novel drug approvals were orphan-designated, compared with 58% (31) in 2020. In just the first two months of 2022, the FDA granted marketing authorisation to four new drugs addressing oncology and haematology rare diseases, namely:

- Immunocore’s Kimmtrak (tebentafusp) for the treatment of adult uveal melanoma (see above);

- Bioverativ’s Enjaymo (sutimlimab-jome) to reduce the need for red blood cell transfusions due to haemolysis in adults with cold agglutinin disease;

- Agios Pharmaceuticals’ Pyrukynd (mitapivat) for the treatment of haemolytic anaemia in adults with pyruvate-kinase deficiency;

- BioPharma’s Vonjo (pacritinib) for adults with intermediate or high-risk primary or secondary myelofibrosis with a platelet count below 50 × 109 /L (1).

Blockbuster potential

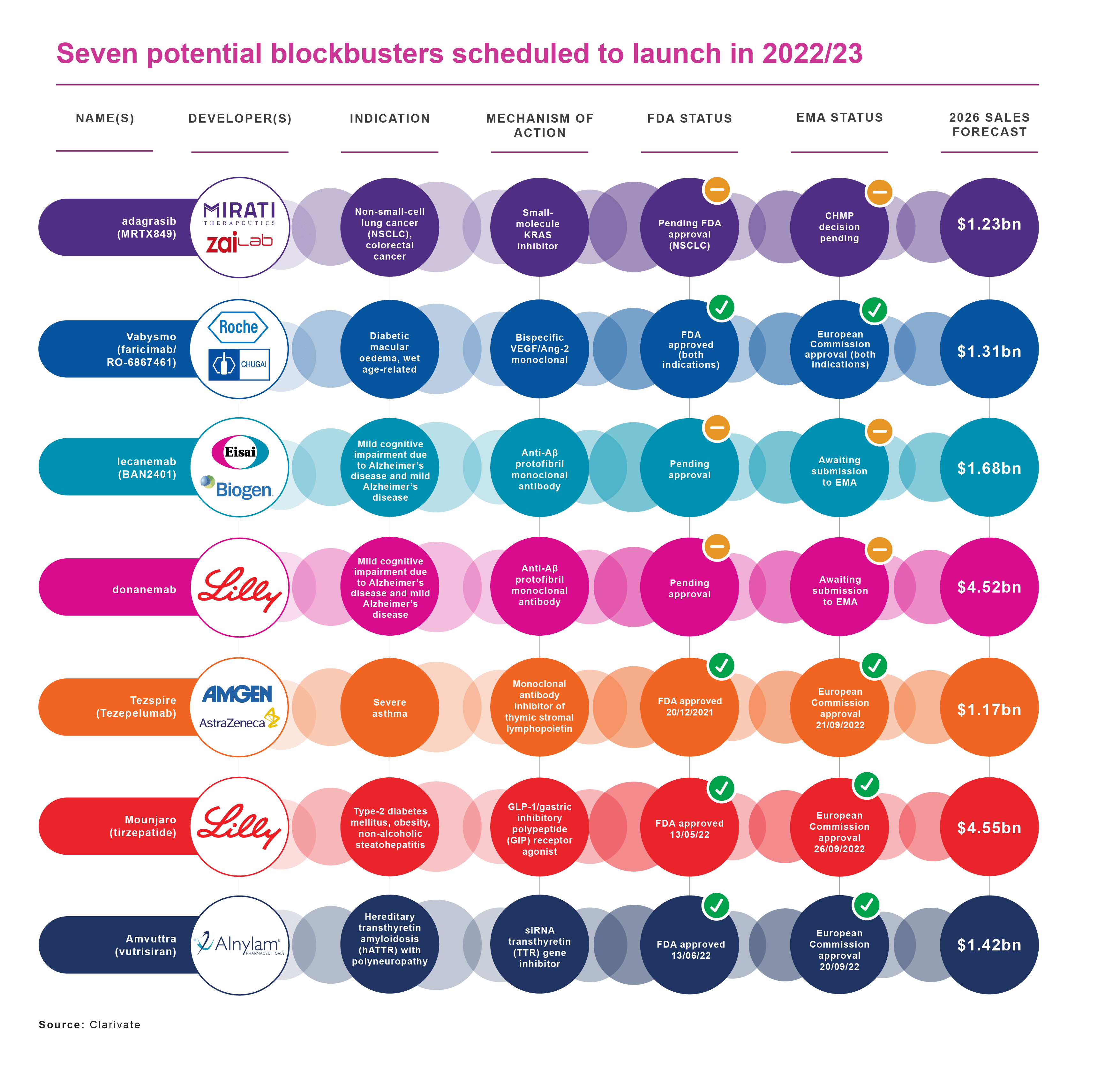

For companies with innovation to sell, pharmaceutical launch success inevitably comes down to revenues, profit margins and lifecycle management. And innovation only has meaning for societies and healthcare systems if new medicines reach and serve patients in need.

Clarivate’s Drugs to Watch report for 2022 lists seven products scheduled to enter the market this year or in 2023 and achieve blockbuster status (annual sales of US$1 billion or more) within five years. That compares with just four potential blockbusters in Clarivate’s Drugs To Watch report for 2021.

From R&D to launch excellence

In the meantime, drug development pipelines continue to prosper. According to Citeline Pharma Intelligence’s Pharma R&D Annual Review 2022, there were 20,109 candidates in active development early this year ̶ 8.22% more than in the previous year’s analysis, when pipeline growth year-on-year was 4.76%. Particularly notable was an 8.7% increase in Phase III pipeline assets, a considerable leap from the 0.9% year-on-year growth seen in 2021.

In terms of therapeutic areas, cancer drugs were way ahead of the field, with 7,772 projects in the R&D pipeline as of early 2022 and a year-to-year increase of 14%. Despite the boost to the category from COVID-19, anti-infectives came in third after neurological therapies, with pipeline growth of 4.7% (22.4% in 2021-2020).

All of this suggests that, despite some worrying signs in the US market, the pharmaceutical industry is still generating attractive new launch prospects, some of them with potential to transform patients’ lives. Yet many challenges remain in the gap between regulatory approval to market access. Pharmaceutical companies must continue working on every front to ensure that R&D productivity translates into drug approvals and that approvals translate into successful launches.

This calls for the right launch management tools, such as SmartLaunch™, so that milestones, timelines and challenges in pharmaceutical launch plans are visible, co-ordinated and actionable in real time across different countries, functional silos and layers of management. That will help companies to launch smarter, launch faster, and align everyone involved in the launch cycle, from clinical development through to market entry.

Only with this kind of 360 degree vision and focus, across the whole spectrum of activities driving launch readiness, can regulatory approvals set the stage for launch excellence. And as major-market approvals fluctuate from year to year, companies need to be all the more confident that they have the capabilities to make each and every launch really count.

Andre Moa

Andre Moa

24 Nov 2022

24 Nov 2022

18 minute read

18 minute read