After another tough year of COVID-19 restrictions, there were some welcome signs of recovery in late 2021. Also emerging, though, were concerns about new viral variants - most recently, Omicron - that could push up hospitalisations and death tolls, ultimately returning countries to lockdown. In this uncertain climate, as we look ahead to significant pharma trends for 2022, people all over the world are having to re-assess the relationship between their personal health, behaviour and freedoms; and their responsibilities towards the health of their communities and of society at large. That is always a delicate balance.

The pharmaceutical industry has already played a crucial role in preventing and treating COVID-19, limiting considerable damage from the pandemic worldwide. Yet pharma also has to maintain a balance: between its freedom to research, invest, and profit from those investments; and its responsibilities towards health systems, regulators, budget-holders and the patients who depend on its innovations. Pharma has responsibilities not just for our health but for the sustainability of the health systems that keep our health in balance. These responsibilities extend to fair or discretionary pricing, cost sensitivity, drug and patient safety, marketing and communications, transparency of data and information, equitable strategies for intellectual property, and the many other components of market access.

As we note below, COVID-19 continues to disrupt and transform industry’s business strategies and practices. In doing so, though, it also offers new solutions to perennial challenges, including pricing, reimbursement and customer engagement, that arise as tensions between innovation, market access and financially pressed health systems play out. And industry’s efforts to combat the pandemic are creating fresh platforms for innovation and growth. The mRNA technology in COVID-19 vaccines is opening up dynamic new possibilities for other diseases, while the far more established class of monoclonal antibodies is proving a long way from exhausted, in COVID-19 and beyond.

Finally, we will see that industry’s health, as well as the health of its patients and the societies they belong to, cannot be separated from the health of the planet. Pharma wants its innovative efforts to be acknowledged and rewarded by health systems in the context of a broader, more holistic conception of value and benefit. Similarly, the industry is recognising increasingly that the health issues it addresses are also about the broader context of living conditions, heat, light, water or environmental sustainability. In taking on those responsibilities, pharma can move closer to the status of a comprehensive health provider, in line with growing health system and societal demand for all-encompassing value. Ultimately, it can embrace disease management in more inclusive ways that help to ensure the industry’s own sustainability.

Pharmaceutical Trends for 2022

Trend #1. COVID-vaccine breakthroughs open up new directions for mRNA technology

The COVID-19 pandemic has put the pharmaceutical industry in the front line of a global public health effort, raising its profile as an innovation-driver and providing welcome relief from years of routinely hostile media coverage. This focus on innovation as a lifesaver, rather than on its cost, risks or relationship to pharmaceutical company margins, has been particularly evident in the largely unconditional excitement generated by messenger RNA (mRNA) technology.

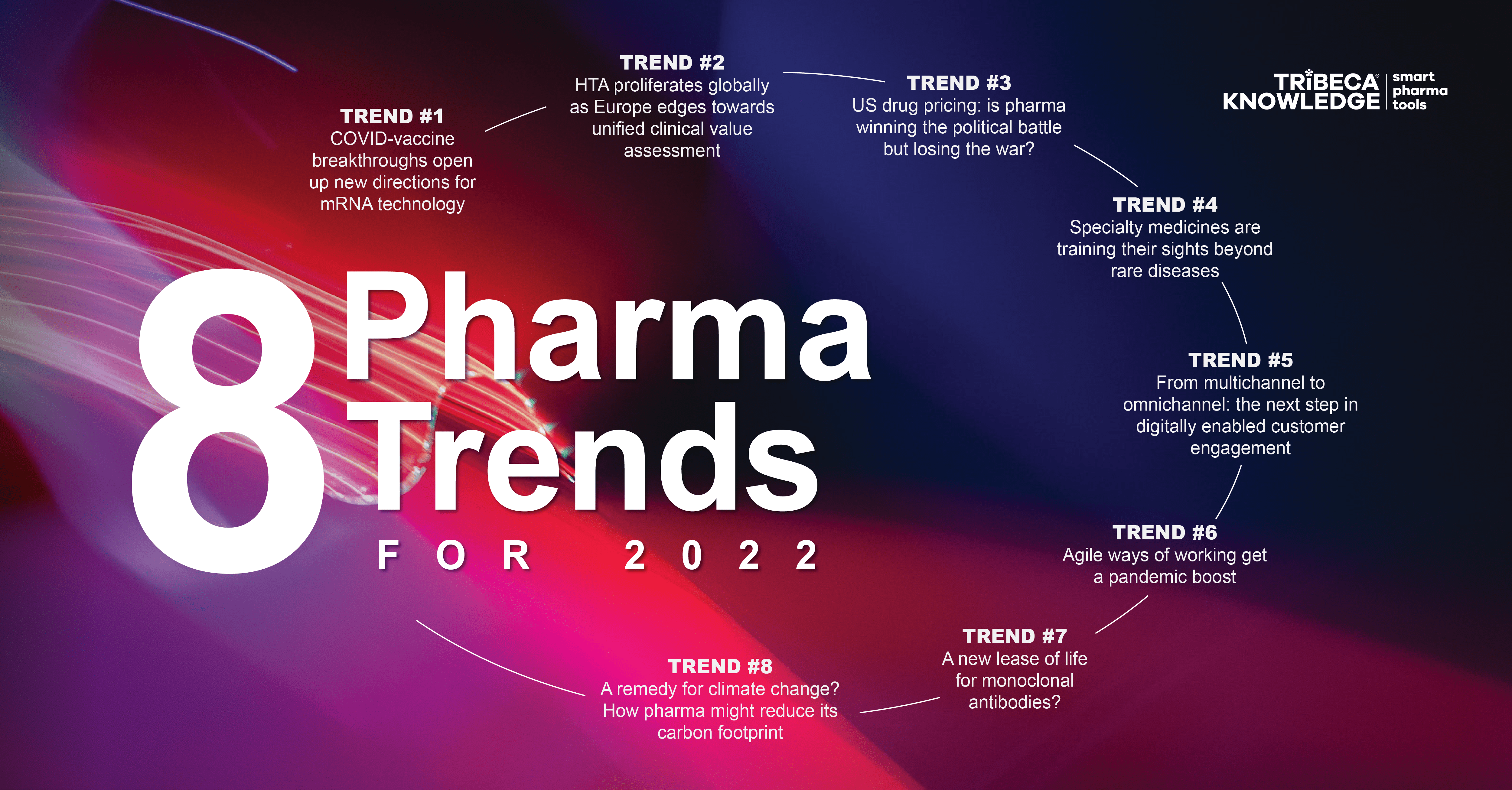

The science behind both the Pfizer-BioNTech (Comirnaty) and Moderna (Spikevax) COVID-19 vaccines has now entered the scientific mainstream after decades of research. It also promises to transform other infectious diseases, such as influenza or cytomegalovirus. Vaccines and therapeutics based on mRNA are under development for conditions ranging from HIV to cancer, tuberculosis, cystic fibrosis, heart disease, asthma and other respiratory diseases.

Speed, adaptability and specificity

With vaccines development, mRNA has the advantage of speed, adaptability and specificity. Mainstream vaccines are based on virus-specific approaches that seek to kill or weaken a target pathogen. An mRNA vaccine takes a non-infectious genetic fragment from that pathogen and use lipid nanoparticles to deliver it into the patient’s own cells, encoding the viral protein to generate the desired immune response. It means scientists can identify the genetic code for an antigen of choice and use proven liposomal delivery systems as carriers for, theoretically, any number of those antigens – swiftly adapting, for example, to mutations in the SARS-CoV-2 spike protein.

There is now talk of a ‘bio-revolution’ sparked by the success of mRNA vaccines, with huge implications for disease management worldwide. A report on this theme by the McKinsey Global Institute in May 2020 estimated that at least 45% of the global disease burden could be addressed using science that is already conceivable today. For example, gene-editing technologies might help control malaria, which is still responsible for some 400,00 deaths a year worldwide. Cellular therapies could repair or even replace damaged cells and tissues.

Figure 1: How mRNA vaccines work

Source: BBC, Nature, Pfizer, CDC

Moderna and AstraZeneca recently reported promising early results from a Phase IIb trial with their mRNA-encoding vascular endothelial growth factor (VEGF-A), AZD8601, in heart failure. Injected directly into the heart muscle of patients undergoing elective coronary artery bypass surgery, the compound showed encouraging signs of improving heart function. The hope is that, by triggering the cellular machinery for production of the VEGF-A protein, AZD8601 can modify the disease process in heart failure patients by stimulating formation of new blood vessels and repair of damaged heart muscle.

mRNA challenges and opportunities

The new mRNA technology is not without its limitations. Targeted delivery is a challenge, for example. The fragility of mRNA molecules means that not only do they need to be safely and effectively encapsulated, but they demand very specific conditions for cold storage and transportation. Nonetheless, the success of Pfizer-BioNTech’s and Moderna’s COVID-19 vaccines may have catapulted mRNA from a technology once regarded as promising, but difficult to commercialise, into a dynamic new frontier for disease management on a global scale.

It could also help to recalibrate pharma’s reputation from issues of pricing, profiteering, data transparency or questionable marketing practices towards what industry would rather see as its true legacy: scientific ingenuity and medical interventions that save lives, ease intolerable pressures on healthcare systems, and put economies back on their feet. A US Gallup poll in August 2019, for example, found that pharma rated lowest among 25 industries assessed annually, trailing behind the legal profession, oil and gas, advertising/public relations, and even the federal government. Americans at that point were twice as likely to rate the pharmaceutical industry negatively (58%) as positively (27%).

Conversely, Harris Poll data in October 2021 showed the industry tracking a 50-60% approval range among the American public in recent months. Before the pandemic hit, around 32% had a positive opinion of pharma. Perhaps the best way for pharma to capitalise on this drastically improved profile is to continue following the science and making sure that science is not only communicated successfully but put in its proper context.

Trend #2. HTA proliferates globally as Europe edges towards unified clinical value assessment

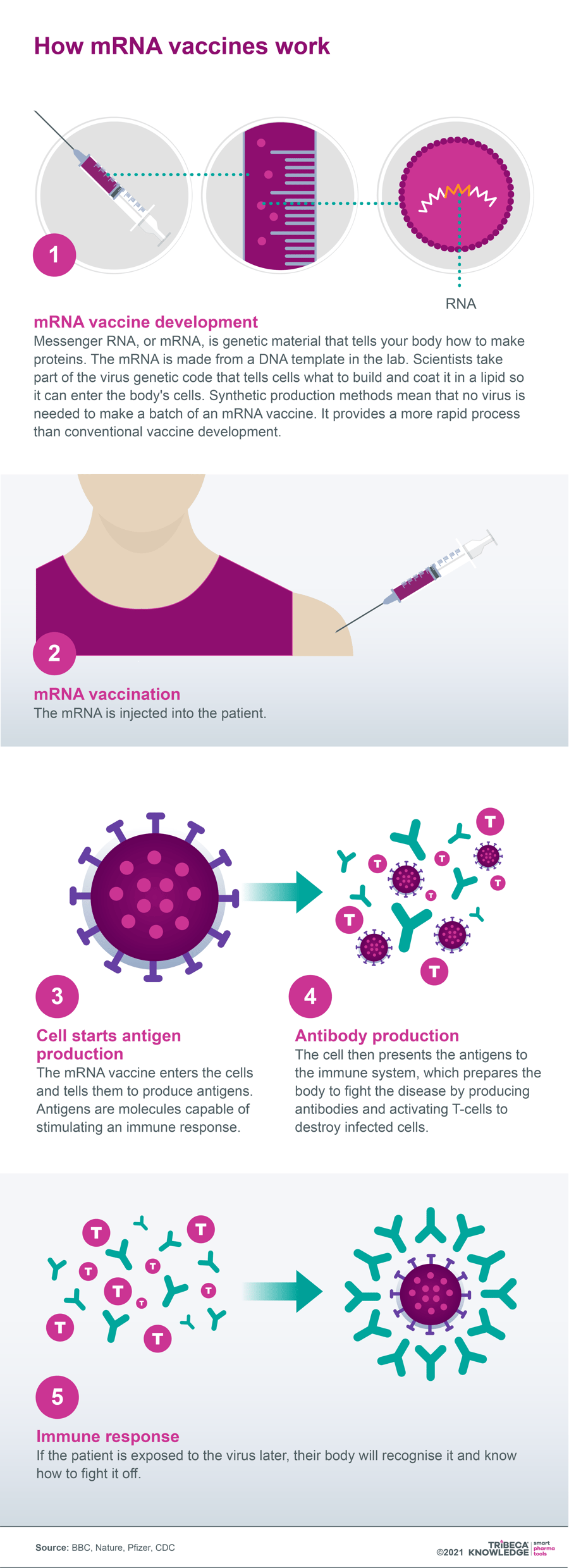

The use of health technology assessment (HTA) to determine the value of medicines to health services or insurers, thereby controlling drug access and costs, is a gathering trend on a global scale. However, HTA criteria and procedures can look very different from market to market.

Figure 2: Global proliferation of HTA

Source: Health Technology Assessment International (HTAi), International Network of Agencies for Health Technology Assessment (INAHTA).

Harmonisation of the regulatory framework for evaluating and approving medicines in the European Union has done much to facilitate and accelerate access to the European market. Nonetheless, reimbursement decisions on medicines, and any pharmacoeconomic assessments underpinning those decisions, have always been left to the discretion of individual EU member states.

This leeway respects the varying demographics, health profiles, budgetary resources and political priorities across the member states. But as EU countries step up efforts to control market access and costs through detailed cost-benefit assessments, with growing emphasis on the affordability and budget impact of new medicines, this ‘fourth hurdle’ can lead sharp market-to-market disparities (compare, for example, HTA procedures in France, Germany, Italy and Spain). These are then aggravated by layers of regional and local assessments. Often the outcome may be significant delays to launches and uptake or, in the worst-case scenario, market withdrawal.

There have been voluntary efforts to smooth out these wrinkles through initiatives such as EUnetHTA, the European Network of Health Technology Assessment. This seeks agreement between member state HTA bodies on common frameworks, principles and methodologies for health technology assessment. However, in recent years the emphasis has shifted towards establishing a mandatory and centralised system of joint clinical assessment (JCA). The focus would be limited to relative-efficacy assessments, still leaving considerations such as drug value and budget impact (together with associated pricing and reimbursement negotiations) to the member states.

The pharmaceutical industry has welcomed this process, or at least its original intent. The European Commission formally set the initiative in motion by adopting a proposal for a regulation on health technology assessment on 31 January 2018, as a means to eliminate duplication and streamline some elements of HTA. These goals are especially pertinent now that COVID-19 has Europe in its grip. The pandemic underlines the need for efficient collaboration and knowledge/resource-pooling to ensure that health systems can cope with surges in demand, and that patients have timely access to the necessary vaccines and medicines.

The new EU HTA regulation

On 9 November 2021, after striking a political deal with the European Parliament in June 2021, the Council of the European Union approved the adoption of the Commission’s amended HTA regulation at its first reading. At the time of writing, the regulation was still awaiting final approval from the European Parliament. It would then be published in the EU’s Official Journal and would start to apply three years after entering into force on the 20th day following publication.

That means the new procedures, which include member state co-operation on JCAs, joint scientific consultations and identification of emerging health technologies, could be in place by late 2024/early 2025. They would also reduce the administrative burden on product developers by requiring only a single, one-time dossier for EU-wide clinical assessment. The proposed timetable should give pharmaceutical companies some firm ground on which to start planning for data requirements, regulatory timelines and other adjustments needed to leverage a potentially significant improvement in the EU market access environment.

What exactly those adjustments will be, and how much of an improvement they actually represent, remains open to debate, particularly as details of the compromise regulation have yet to emerge. Pharmacoeconomic analyses, albeit based on harmonised assessments of clinical benefit, will still be conducted at member state level, with potential for broad variation in modelling, assumptions, budget ceilings or timelines. More clarity is needed in areas such as which member state will lead the JCA process, and the degree of clinical evidence required from industry. There is also some nervousness about the stipulation that member state HTA bodies cannot request the same clinical data once they are submitted for joint clinical assessment.

More generally, there are reports that resistance to centralised interference in established HTA systems, such as the relative-benefit assessments conducted by Germany’s IQWiG (Institute for Quality and Efficiency in Health Care), has watered down the Commission’s original proposal. For example, provisions to ensure that JCAs are incorporated into national HTA procedures are less robust than industry had hoped for. Moreover, the plan is for a staggered roll-out of joint clinical assessment, starting with cancer drugs and advanced therapies, then moving onto orphan drugs after three years.

While these provisions may be sub-optimal from an industry perspective, with too much leeway for further barriers and inefficiencies at national level, they will at least bring some transparency and predictability to an arena that can all too easily throw drug-launch plans in Europe off course. The next year or two will be crucial, though, in determining just how far HTA harmonisation in the European Union can go. The shadow of COVID-19 also falls over HTA procedures, with the risk that escalating demand on health system finances and resources will require even tougher decisions on drug value and affordability.

Moving towards a more holistic understanding of the value of drug innovation

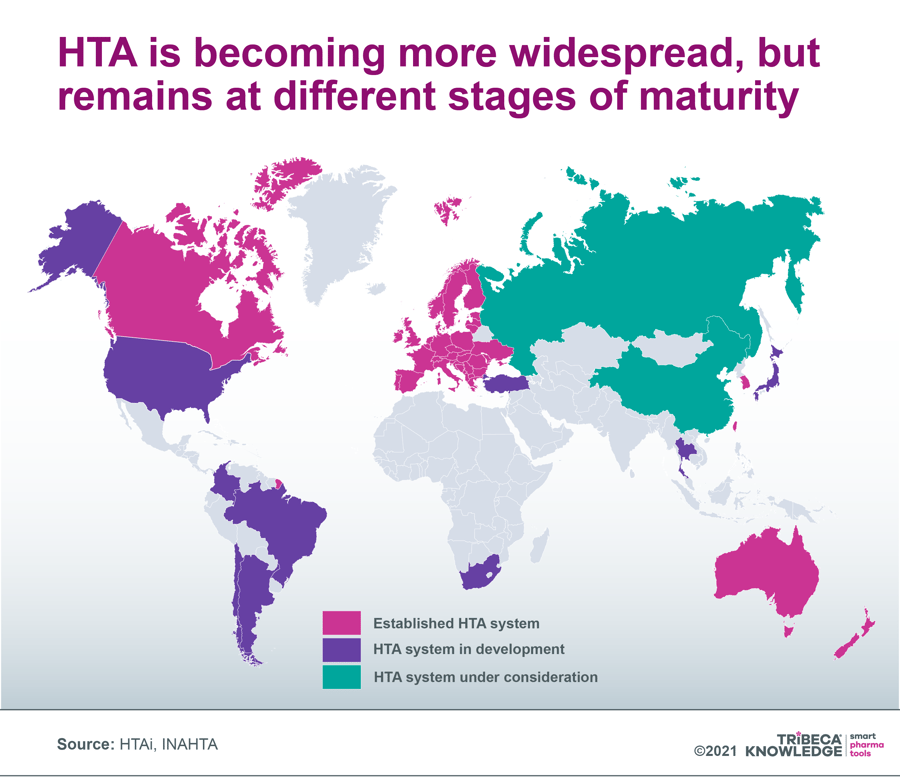

The evolution of a JCA framework in the EU illuminates broader issues with the heterogeneity of HTA systems as they proliferate worldwide. Not only are these systems at different stages of development; they also examine different elements of a drug’s value proposition. For example, all of them are concerned with unmet need and clinical effectiveness, yet only some consider degree of innovation, the product’s cost-benefit equation or its budget impact.

Moreover, there is no standardised global definition of value, while direct (e.g., transportation, day care) and indirect (e.g., time out of work) non-medical elements, as well as intangibles such as pain and suffering or unintended societal consequences (e.g., grandparents no longer able to look after their grandchildren) are generally overlooked. If the direction of travel for HTA globally is towards increasing harmonisation, then industry does not want to see convergence around lowest common denominators.

Instead, companies are looking for a more holistic understanding of drug innovation that goes beyond the relatively narrow value judgments currently applied by HTA agencies. That would hopefully recognise the full range of long-term cost offsets and societal gains available from products that truly expand the boundaries of medicine.

Figure 3: The Value Flower: Towards a more holistic understanding of drug value and innovation

Source: ISPOR: Novel Elements of the Value Flower: Fake or Truly Novel?

Trend #3. US drug pricing: is pharma winning the political battle but losing the war?

As COVID-19 continues to put healthcare systems under unprecedented financial and operating pressure worldwide, government concerns about the sustainability of rising drug prices are still very much a live issue. Of particular note are speciality drugs that target rare disease indications, and the more recent emergence of costly ‘one-shot’ cell and gene therapies. Nor is the issue confined to breakthrough therapies with claims to revolutionise treatment standards and practices.

In the still pivotal US market, for example, a recent report by the Institute for Clinical and Economic Review (ICER) found that price increases on AbbVie’s established blockbuster Humira (adalimumab) drove up healthcare spending by $1.4 billion in 2020, without adequate new evidence of substantial additional clinical benefit in rheumatoid arthritis and other chronic inflammatory diseases. Alarmingly, a net price increase (i.e., post-rebates) of 9.6% for Humira in 2020 actually exceeded inflation in the drug’s wholesale acquisition cost or list price (+7.3%).

The ICER analysis adds fuel to the latest in a long line of efforts by US administrations to control prices in what remains essentially a free market for medicines. According to some estimates, drug companies generate three-quarters of their worldwide profits in the US. Therefore, the market’s influence on global pricing and R&D investment cannot be overstated. Like his predecessor, President Joe Biden campaigned on the promise of managing drug prices, including proposals for external reference pricing in Medicare Part B and potential expansion of those policies to Part D medicines. Yet the Biden administration has found it similarly difficult to drive these drug pricing measures through the US Congress.

In Biden’s case, the problem is not just pharmaceutical industry resistance and Republican opposition in Congress, but intransigence within his own party. The result was that, in late October, the administration shelved an ambitious plan that would have given Medicare authority to negotiate lower prices for new medicines. The setback came despite the Democrats controlling both houses of Congress and apparent broad support from the US public.

Biden has secured the Democrats’ agreement for a revised proposal, under which Medicare would be able to negotiate the prices of high-cost prescription drugs in both Medicare Part B and Part D. However, this would only happen gradually and after a set period on the market (nine years for small-molecule drugs, 12 years for biologics). Biden’s compromise plan would also include tax penalties if pharma companies raised prices faster than inflation, a monthly cap on out-of-pocket costs for insulin, and a more general cap of $2,000 per year on out-of-pocket payments for pharmacy dispensed Medicare Part D medicines.

Compromise proposal could still be game-changing

Meanwhile, payers worldwide will continue to insist on demonstrable value as a condition of market access. And US commercial insurers will continue to apply a range of measures (formulary design, negotiated discounts and rebates, patient co-payments, prior authorisation, etc) to keep costs down, as well as paying growing attention to ICER cost-benefit evaluations. With potential value-based pricing on the agenda, even in the latter stages of the product lifecycle, the pharmaceutical industry will be watching carefully in 2022 to make sure it does not win the battle but lose the war in what remains a critical market for revenues, margins and keeping the innovation wheels turning.

Trend #4. Specialty medicines are training their sights beyond rare diseases

Cost concerns about the rising tide of speciality medicines have been a familiar refrain in the pharmaceutical sector for many years now. They are amplified by the growing prevalence of premium-priced targeted therapies for rare diseases or ultra-orphan medicines. That might involve a succession of narrow indications within much broader therapy areas (e.g., oncology). According to leading US prescription benefit manager CVS Caremark, specialty treatments accounted for 52% of its members’ pharmacy expenditure in 2020, despite being concentrated in a relatively small number of therapeutic categories.

‘Salami-slicing’ or ‘indication-stacking’ is a well-established strategy in the speciality drugs space, as manufacturers look to the long game on market entry and lifecycle management. For example, Clarivate’s latest Drugs To Watch report lists only four drugs set to enter the market in 2021 or 2022 and to achieve blockbuster status (annual sales of US$1 billion or more) by 2025. As we noted in our recent review of new drug approvals and prospects in 2021, that partly reflects a preference for specialty drugs launching with highly tailored initial indications, then expanding into additional areas over several years.

Indication-stacking enables companies to leverage orphan-drug incentives and lock in premium prices, geared to uptake in small, precisely defined populations, across multiple new indication launches. Meanwhile, the trend to specialty continues, and payers are feeling the heat of products that emphasize value over volume, yet have not abandoned volume as a long-term ambition. All the more so now that cell and gene therapies (CGTs) are emerging as a serious medical and commercial consideration in the rare disease space.

Like other specialty drugs, CGTs will not be content just with transforming the therapeutic paradigm for a handful of patients. As the technology rapidly evolves, and industry steps up investment in CGTs (nearly 3,500 products currently in development worldwide), the needle is shifting from autologous to allogeneic or ‘off-the-shelf’ therapies and stem-cells. Similarly, the initial marked emphasis in CGT pipelines on oncology and other rare diseases is shading into far more prevalent conditions, such as Alzheimer’s and Parkinson’s disease, HIV/AIDS, hypertension, multiple sclerosis or heart conditions.

Cost implications of widening the specialty field

Given current cost levels, not just for the products themselves but for the highly specialised resources needed to administer them, the long game here could be a complete realignment of health system structures and strategies for addressing disease. It could also be a leap in the dark for HTA agencies, in assessing cost-benefit ratios to inform acceptable pricing, and for payers used to spreading the costs of disease over a patient’s lifetime and/or ceasing coverage once a therapy ceases to be effective. This is especially challenging when CGTS are coming to market without long-term or real-world experience of safety and efficacy.

Legal or regulatory intervention to curb any perceived exploitation of accelerated approval or orphan-drug incentives when specialty drugs go large may remain a vain hope. But manufacturers will still need to maximise process efficiencies, from laboratory through clinical trials to manufacturing scale-up and product administration, if they want to temper the high costs used as justification for pricing CGTs and other specialty therapies at what critics regard as unsustainable levels.

Whether warranted or not, these premium prices tend immediately to attract media interest, thereby helping bring cost-containment strategies into play. In the case of bluebird bio’s gene therapy Skysona (elivaldogene autotemcel), the company ended up withdrawing an EU marketing authorisation due to difficulties securing reimbursement in Europe. Industry will need to educate the media and the general public on how medical breakthroughs are created and leveraged. It will also have to get creative about gathering data on health system and societal cost offsets associated with specialty drugs ̶ more challenging when these start off in small populations ̶ while engaging with payers on novel reimbursement strategies.

These latter include outcomes-based contracting, with installments paid when efficacy thresholds are met; longer-term annuity or ‘mortgage’ payments; ‘Netflix’ or subscription-based models, whereby payers offer a flat fee in return for unlimited access to treatments; risk-pooling insurance schemes that may spare insurers (particularly in the US) from sustaining enormous upfront costs for CGTs, only for the patient to switch to another scheme; or, in the case of orphan drugs, pricing by indication.

Manufacturers need to be realistic about the budgetary tolerance and available resources in healthcare systems for specialty therapies, especially with COVID-19 weighing so heavily on overall capacity. Proactive, informed and open-minded dialogue on value, cost and affordability with governments, payers, health systems and other stakeholders will help to avoid specialty therapies running into a brick wall as they seek a larger presence in the marketplace.

Trend #5. From multichannel to omnichannel: the next step in digitally enabled customer engagement

Digital transformation prompted and accelerated by the COVID-19 pandemic has galvanised the pharmaceutical industry at just about every level of its operations, from R&D through to manufacturing and commercialisation. That includes marketing, advertising and customer engagement, where a rapid increase in digital adoption has radically altered the competitive landscape. It has reset customer expectations and patterns of demand while providing access to wide-ranging, independent sources of information on medicines and health.

This communications revolution has gone hand in hand with growing diversification of the industry’s customer/stakeholder base; reduced access through conventional channels to key arbiters of product choice (e.g., prescribing physicians); and digital advances that enable precise customer profiling and targeting, as well as networked communications across multiple channels. At the same time, digital transformation has effected a sea change in the scale and sophistication of digitally enabled consumer marketing, spearheaded by retail giants such as Amazon. These strategies may leave pharma’s routine claims to patient centricity looking distinctly tentative.

Restricted access under COVID-19 restrictions has encouraged patients to embrace digital tools, take more charge of their own health management, and develop new relationships with health systems or healthcare professionals. According to the 2021 Accenture Health and Life Sciences Experience Survey, for example, 32% of participants had a virtual consultation with a healthcare provider this year, compared with just 7% in early 2020. Patients are investigating the full range of information sources on health conditions and treatments, beyond the scope of pharma influence.

In parallel, healthcare professionals are becoming increasingly comfortable with digital devices, media and interaction, particularly as COVID-19 undermines the traditional pharma sales model of face-to-face rep visits. It is for pharma to make sure these upheavals are leveraged into new ways of engaging with a broader, richer customer base, rather than succumbing to loss of influence and authority in an increasingly random, digitally fragmented universe.

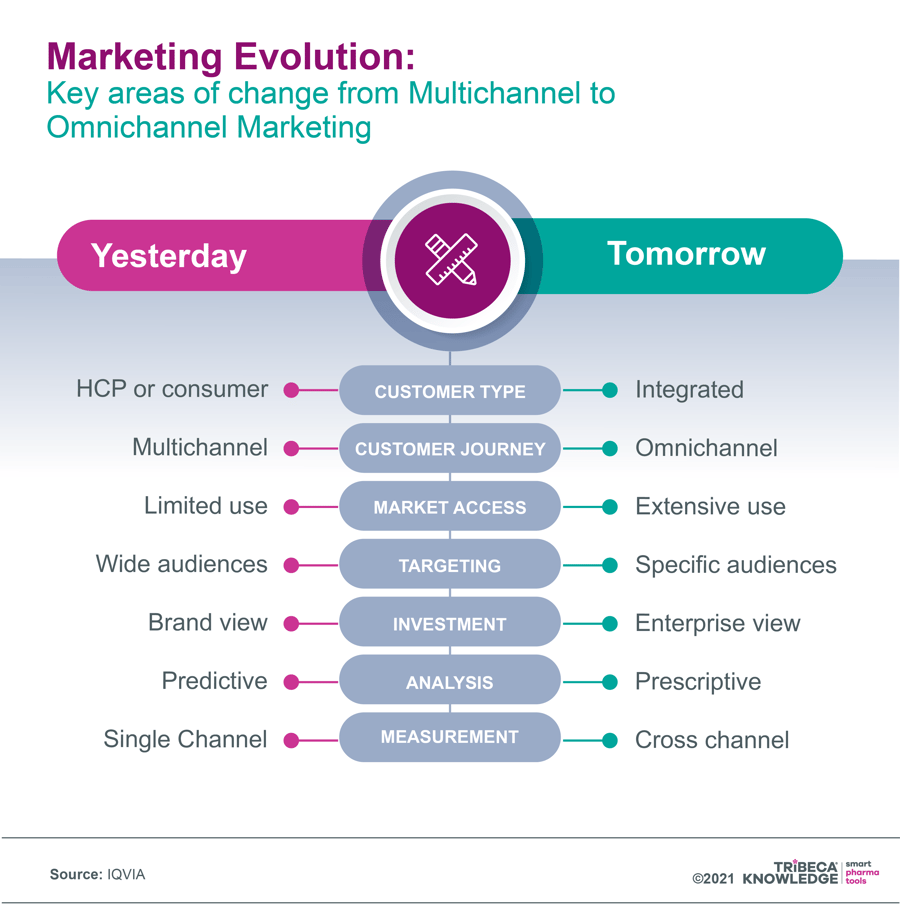

Transitioning from multichannel to omnichannel

One way of doing this is by transitioning from a multichannel to a more seamless, integrated omnichannel marketing model. In other words, moving beyond simply using all the available channels for pharma sales, marketing and communications, and towards creating a harmonised customer experience that exploits the various links between those channels. With a carefully designed omnichannel strategy, companies can do justice to increasingly complex innovative medicines by mapping customer journeys and tailoring their marketing to all the available customer touchpoints, delivering consistent, personalised messaging in multiple formats and settings.

Multichannel marketing capabilities have already significantly expanded pharma’s sphere of influence and outreach, using digital technology and media to supplement traditional communication channels in engaging directly or indirectly with customers and stakeholders. However, this can lead to a broad mix of channels operating in isolation. It may favour channel diversity over precisely tailored content that reinforces the user experience from other channels, whether on- or offline.

Not only does this risk squandering marketing investment and resources through duplication, mismatched messaging or customer saturation. It can also hamper ongoing strategy and effectiveness by limiting key performance indicators to channel specific feedback. This overlooks the holistic impact of communications across multiple platforms, even if it may suit siloed interests and priorities within individual businesses.

Figure 4: From Multichannel to Omnichannel Marketing

Source: IQVIA, 7 June 2021: Moving pharma marketing from multichannel to omnichannel

Some pharma companies have been relatively slow to embrace omnichannel best practices in marketing. They do require a good deal of planning and adjustment, from attitudinal change and reorganisation to adoption of a genuinely customer-centric mentality. They also call for consolidation of internal platforms so that the impact of marketing outreach can be tracked holistically across multiple channels. There are risks too, around data security and privacy (particularly as relationships become more interactive), lack of available customer data to inform targeting in some markets, or uncertainty over whether customers and stakeholders may return to more conventional interactions once the COVID-19 fog has lifted.

All the same, the potential benefits of creating a unified customer experience, wherever and whenever the interaction occurs, may be hard for pharma to ignore. Digital marketing in retail and other sectors has acclimatised customers to engaging on their own terms and in their own time, with the freedom to extend that conversation into unmanaged territories such as social media. It is up to pharma now to seize the opportunities for seamless, responsive and holistic communications that leverage the full range of available platforms. Or, it can let customers and stakeholders take the lead, switching off from an avalanche of uncoordinated messaging across channels that won’t speak to each other.

Trend #6. Agile ways of working get a pandemic boost

Just as COVID-19 has accelerated the digital revolution in the pharmaceutical industry, both the pandemic and digital transformation have stimulated and enabled more agile ways of working and thinking in pharma. The rapid development and approval of COVID-19 vaccines, optimising collaborative efforts and strategies such as parallel phases of clinical development, is only one example of agile teamwork in action.

More generally, agile project management reflects the industry’s need to maximise its creativity, productivity and efficiency. That is a symptom of a pharma operating environment increasingly concerned with managing drug costs. Agile working also provides the flexibility and responsiveness to refine and tailor real-time value of products and services. Today’s pharmaceutical market is in constant flux, with an ever broader, more heterogeneous, digitally enabled and demanding customer base.

The concept of agile transformation came from software developers, who used it to accelerate speed to market. Latterly, its influence has spread across a broad range of business and organisational settings, including pharmaceuticals. With digital technology and media driving an explosion in the availability and flow of data, customers and stakeholders are now better informed and more empowered than ever. They want and expect the right content and the right kind of interaction, delivered at the right time and through the channels of their choice.

By restricting face-to-face contact while hastening uptake of digital technologies and media, the COVID-19 pandemic has encouraged pharma to rethink the way it does business from the bottom up. One consequence of that re-assessment is a transition from digital to agile and back again, as the needs of agile working prompt further digital innovation. This can be seen, for example, in clinical development, where limited access to trial sites under COVID-19 restrictions has fast-tracked industry uptake of tools, technologies and strategies to enable remote or hybrid clinical trials. These new capabilities equip companies with the agility to better identify and segment potential clinical trial participants at the start of the process, then shape those trials to the preferences or abilities of individual patients – all to the benefit of efficiency, cost-effectiveness and inclusiveness.

At the same time, interactive data flow, remote monitoring, home care and mobile devices for recording real-life patient outcomes in virtual/hybrid trials (e.g., wearables that use sensors to track physical activity, as it occurs, in cardiovascular - or Parkinson’s-disease patients) open up possibilities for new digital endpoints in clinical trials. They may offer more accurate, timely and comprehensive measurement of a broader range of outcomes that better reflect the full range of patient experience.

Implementing agile can be tricky

Ideally, a digitally enabled agile mindset should be enhancing productivity, creativity, speed and efficiency in every field of pharmaceutical operation, from drug discovery through to launch readiness, in-market activities and lifecycle management. Inevitably, though, there will be some resistance to mindsets and practices that rely on team-based, collaborative experimentation, such as learning through failure, transparent communications and short-cycle strategy development.

Agile working also raises issues of cultural change and ownership. The pharmaceutical sector has for most of its life been highly process-oriented, favouring extended planning cycles, established hierarchies, siloed organisations, and reluctance to take on more risk than is necessary. That is not surprising in an industry where so many drug candidates fall by the wayside, where strong regulation and compliance are paramount, and where even minor setbacks or misjudgements can have a seismic impact on products in development or in the marketplace.

Addressing market and productivity challenges through agility is an attractive and necessary proposition in the post COVID-era. Rather than reverting to standard practices, pharma must adapt to survive, or at least to prosper. That means identifying the right digital tools, cultural shifts and management processes to embed agility as an essential component of steering medicines successfully from concept through to the marketplace and beyond.

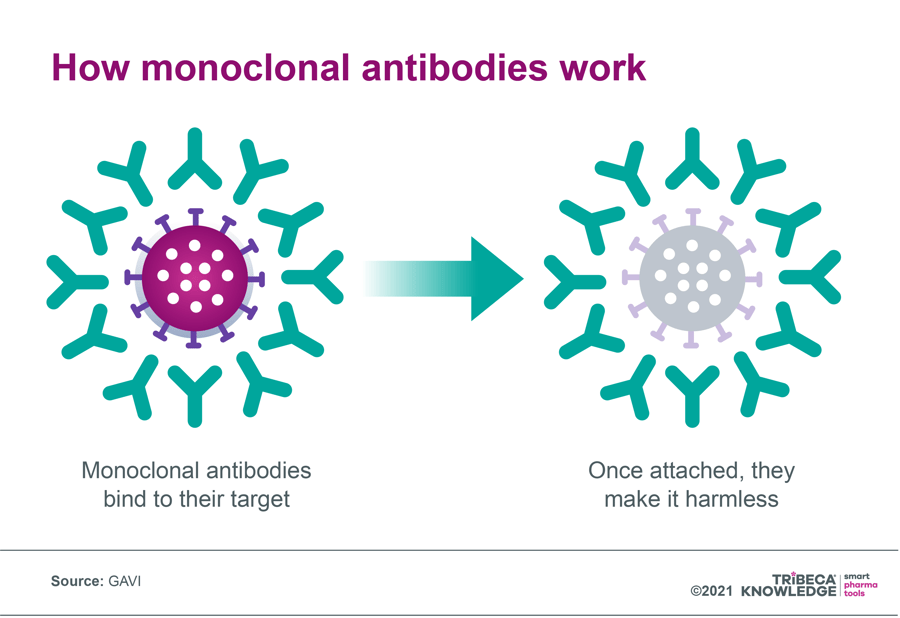

Trend #7. A new lease of life for monoclonal antibodies?

One eye-catching feature of the 08-11 November meeting held by the European Medicines Agency’s CHMP was the committee’s approval recommendations for two monoclonal antibodies indicated for the treatment of COVID-19: Celltrion’s Regkirona (regdanvimab) and Roche’s Ronapreve (casirivimab/imdevimab). Both drugs were immediately rubber-stamped by the European Commission. The US Food and Drug Administration had already granted emergency-use authorisations to several mAb cocktails or single antibodies for use in high-risk COVID-19 patients.

By today’s standards of cutting-edge medicine, including highly disruptive cell and gene therapies, monoclonal antibodies are reliable warhorses. Without doubt they have revolutionised, with growing specificity, the treatment of conditions ranging from cancer to cardiovascular, inflammatory and infectious diseases. All the same, mAbs have been on the market in various forms now since 1986. They continue, nonetheless, to be a mainstay of the dominant biologics segment in the pharmaceutical market, particularly in treating cancer and rheumatoid arthritis. They also remain a compelling presence in R&D pipelines (2,484 products in development as of February 2021, versus 2,224 at the same point in 2020, per Pharmaprojects).

Figure 5: How monoclonal antibodies work

Source: GAVI, 7 October 2020: What are monoclonal antibodies – and can they treat Covid-19? (originally published by Wellcome)

According to one estimate, the mAb market worldwide was worth US$39.10 billion in 2021 and could reach US$50.62 billion by 2026, delivering compound annual growth of 5.3%. Another source was significantly more bullish, valuing the global therapeutic monoclonal-antibody market at around US$115.2 billion in 2018, with potential to hit US$300 billion by 2025. So, is COVID-19 is just one factor energising a new lease of life for mAbs?

As the GAVI vaccines alliance notes, in 2020 over 70 monoclonal antibodies were in development specifically for COVID-19. By contrast, just seven of more than 100 licensed mAbs were for treating or preventing infectious diseases. Along with the new possibilities in COVID-19, there is hope that monoclonal antibodies will make headway against other infectious diseases, such as different strains of HIV or the Ebola virus. Denmark’s Lundbeck recently launched a Phase II proof-of-concept trial assessing its investigational mAb Lu AG09222 for the prevention of migraine.

In October 2020, the US FDA granted its first ever marketing approval to a treatment for Zaire ebolavirus in adults and children. This was Regeneron Pharmaceuticals’ Inmazeb, a cocktail of the mAbs atoltivimab, maftivimab, and odesivimab-ebgn. Fungal infections and even Alzheimer’s disease are among other promising areas of research and development for mAbs, albeit hampered so far by conflicting trial results and manufacturing challenges.

Where mABS have an edge

Since they are based on natural processes, monoclonal antibodies should be less susceptible to safety problems than chemical compounds and can be rapidly developed. They also provide almost immediate protection against infection, and in all types of patients, including the very old, the very young and the immunocompromised. Nonetheless, manufacturing mAbs is complex and expensive. This has resulted in high prices (anything from a median $15,000 to $200,000 per year in the US, according to GAVI) and limited distribution focused on high-income countries. As things stand, GAVI says, nearly 80% of monoclonal antibodies are sold in the US, Europe and Canada. Even where mAbs are registered in low - and middle-income countries, they are often unavailable through public health systems.

New applications for mAbs, in COVID-19 and beyond, carry the promise of significant therapeutic advances in tackling truly global health challenges. For that to happen, though, access and affordability will need to be part of the conversation, whether through manufacturing efficiencies, accelerated registration in low-income countries, genericisation, differential pricing or voluntary licensing.

Trend #8. A remedy for climate change? How pharma might reduce its carbon footprint

Global responses to the outcomes of the 26th United Nations Climate Change Conference of the Parties (COP26) in Scotland during October and November 2021 were at best equivocal. Nonetheless, the pharmaceutical industry was keen to emphasise that it was on board with the COP26 objectives, whether through actual involvement (GSK was among the principal partners) or more generalised expressions of solidarity.

We should all be properly grateful to pharma for pulling out the stops and developing in record time the vaccines now helping to mutate COVID-19 from pandemic to endemic. For all that, though, more than a few people receiving a COVID-19 vaccine must have wondered what was happening to all the single-use plastic and other equipment involved in delivering injections. That is to say nothing of potential hydrofluorocarbon gas emissions from refrigerators used to keep vaccines at low temperatures, or the additional pollution created by airplanes or road vehicles transporting COVID-19 vaccines to treatment centres and patients around the world.

It would be a cheap shot, of course, to carp at pharma or health systems for mustering available resources to address a global health crisis as rapidly and effectively as possible. But it does bring home the difficulty of reconciling pharma and climate change: keeping pace with disease development and regulatory mandates while trying to promote and manage environmental sustainability.

How climate change and health overlap

Climate change and health are fundamentally interconnected, beyond the basic economics of managing disease in countries where global warming has diverted limited resources to tackle environmental disasters. This is recognised by the wider industry and by companies particularly concerned with diseases prevalent in low-income markets, such as Sanofi. For example, vector-borne diseases associated with mosquitos, fleas and ticks, like malaria, dengue fever, Zika or Lyme disease, are influenced by climate change factors such as varying temperature and humidity levels, Sanofi notes. Air pollution is a major risk factor for respiratory and other diseases, it adds.

Moreover, as Bristol-Myers Squibb has pointed out, climate change poses potential commercial risks for companies and the pharmaceutical industry in general. “We have commercial operations worldwide, exposing us to diverse climates and regulatory environments,” it states. “Our long-term ability to operate and provide patients with the medicines they need is at risk without reliable sources of energy and clean water.”

Ahead of the COP26 discussions, a joint statement by several national and pan-national industry associations, including IFPMA, EFPIA, PhRMA and JPMA, insisted that pharma was fully committed to partnering globally with governments and health systems in taking concerted action against climate change. “We are investing in research and development in greener products, as well as more sustainable production and distribution practices, that enable us to deliver medical innovation to patients in ways that protect and support the environment,” the statement read. It cited company initiatives to reduce carbon emissions across their operations and value chains, invest in renewable electricity and energy-efficiency measures, and recycle/ cut water usage.

According to these associations, 80% of their largest member companies have set net-zero or carbon neutrality targets, while many more have committed to “ambitious” short-term reduction goals for greenhouse-gas emissions. GSK, for example, has a range of renewable-energy projects in play, including a 20-year Power Purchase Agreement involving electricity supply from two new wind turbines, and a solar farm for its Irvine manufacturing site in Scotland. The company is also developing a lower-emission propellant for metered-dose asthma inhalers which, if successful, could cut greenhouse gas emissions from inhalers by 90%, GSK says.

Another recent initiative was the Energize programme announced between 10 pharmaceutical companies, energy-management and sustainability specialist Schneider Electric, and Carnstone, a management consultancy specialising in environmental, social and corporate governance. It aims to leverage the scale of pharma’s supply chain to engage suppliers pre-competitively in encouraging a shift towards renewable-energy provision.

Delivering on sustainability commitments

While these efforts are commendable, the industry may still have a long way to go before it can deliver collectively on its sustainability commitments. There are conflicting opinions on just how much environmental damage pharma does, with some researchers claiming it is more carbon-intensive than the automobile industry. Moreover, the complexity and diversity of the industry’s global supply chain mitigates against effective action at all levels. Regulatory requirements, such as paper information leaflets in all medicines packaging, may also limit the scope for sustainability gains.

All the same, and in keeping with other large industries, climate change is increasingly integrated into the regulatory framework for pharma, along with corporate social-responsibility policies and business strategies. These get an extra push from public opinion and green-conscious investors. More pragmatically, investors view sustainability as something that can not only clean up the planet but cut costs and improve the bottom line.

Furthermore, the industry needs to be part of a bigger health solution, in line with its call for more holistic HTA and reimbursement policies. That is already being addressed through ‘beyond-the-pill’ strategies, data analytics or other products or services designed to support cost-effective healthcare decision-making, while also giving the industry more access and influence in health systems.

The evolving conception of ‘whole health’ now extends to the environment. Ultimately, green policies in pharma are not just about playing to eco-conscious shareholders, ticking regulatory boxes or enhancing efficiency. They may also help to broaden and deepen industry’s role globally as a comprehensive and conscientious health provider.

Rising to the challenges of 2022

As we have outlined in this blog on pharma trends for 2022, the coming year once again presents pharmaceutical companies with significant challenges and opportunities, reflecting both organic market developments and the disruptive impact, both negative and positive, of a continuing global pandemic. Among other effects, COVID-19 has deepened uncertainty over timelines and outcomes in the HTA, pricing and reimbursement procedures that increasingly shape pharmaceutical market access.

A digital tool such as SmartAccess™ can help to manage these shifting timelines more efficiently, while providing real-time visibility of pricing, reimbursement or HTA status. Given the rapid pace of change addressed in this pharmaceutical industry analysis 2022, companies need to be all the more confident that their products can be launched and taken up in the marketplace with the best available impact. That means optimising digital solutions to maintain alignment across the board in launch and market access plans and execution.

A 360⸰, real-time view of progress and challenges from market to market will help to ensure that 2022 is not just another year of wondering when the world can stop talking about COVID-19. With the right strategies and technologies, it can also be a year in which industry builds on its pandemic-related achievements to reinforce a positive agenda of innovation, growth and a widening role in managing and maintaining health in all its many forms.

TRiBECA® Knowledge provides smart business tools that help pharmaceutical and biotech companies to optimise launch execution, cut speed to market and to successfully commercialise their products. Our family of SaaS platforms drives agility, transparency, collaboration and efficiency across brands, functions and countries worldwide. Our innovative tools are designed to help you execute with excellence in pipeline planning, launch readiness, market access and tender management.

Andre Moa

Andre Moa

8 Dec 2021

8 Dec 2021

39 minute read

39 minute read